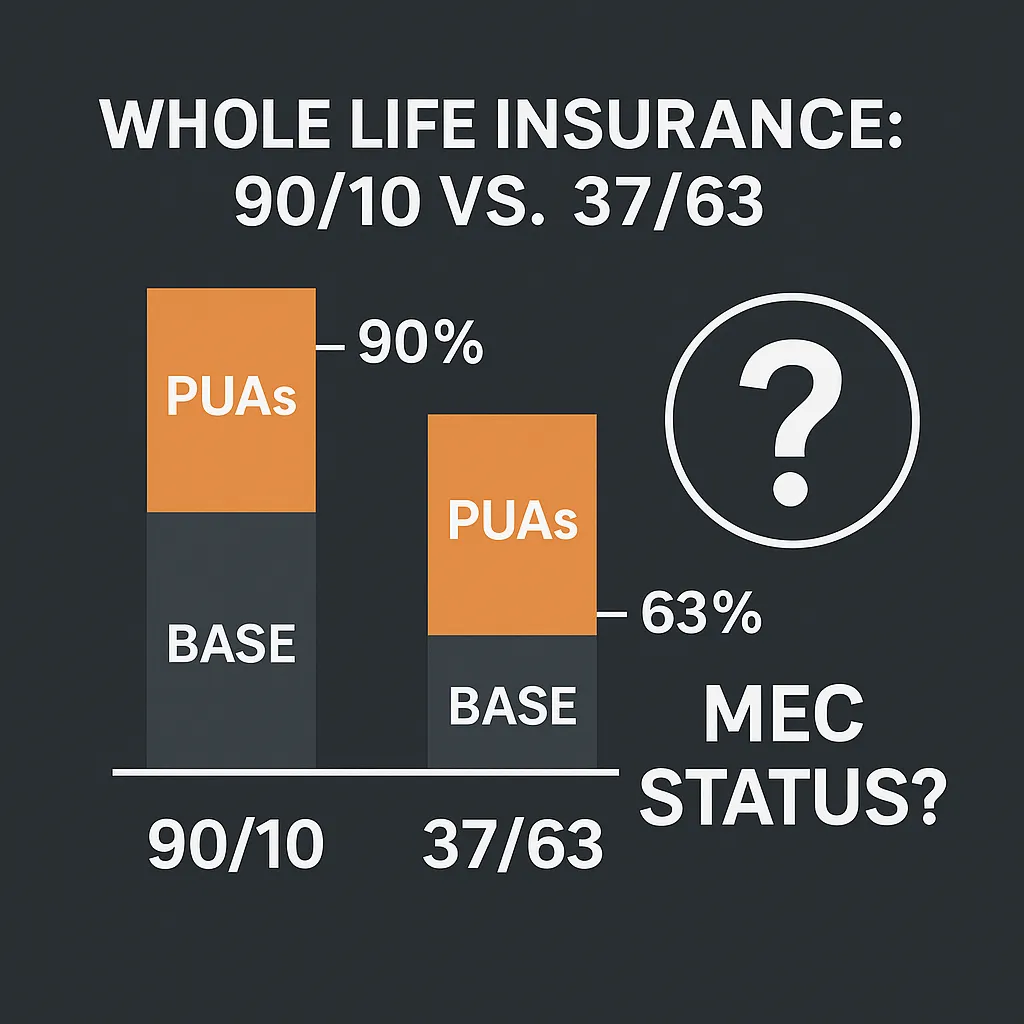

Whole Life Insurance: 90/10 vs. 37/63 (60/40) – What You Need to Know

When people first hear about whole life insurance structured for cash value, the numbers can be confusing. You’ll hear ratios like 90/10 or 37/63 thrown around, and it’s not always clear why they matter or why your agent might push one design over the other. Let’s break it down.

What the Ratios Mean

In a whole life policy, your premium can be split into two pieces:

Base premium – this is the traditional whole life component that builds guaranteed cash value and death benefit over time.

Paid-Up Additions (PUAs) – this is the flexible part that supercharges cash value in the early years.

A 90/10 policy means 10% goes to base premium and 90% goes to PUAs. A 37/63 policy puts 37% into base and 63% into PUAs.

Why 90/10 Is Popular

The reason you’ll see financial strategists recommend 90/10 is simple: cash value is available faster. With more premium going into PUAs, you can access liquidity much sooner, which is attractive if you want to use the policy for investing, business, or building a cash flow system.

I’ve seen plenty of illustrations where 90/10 designs work fine and don’t trigger a MEC. The insurance company runs those tests automatically. If the illustration says it’s not a MEC, it’s not.

Why Some Agents Push 37/63

When an agent tells you 90/10 is “unstable,” what they often mean is that it leaves less margin for error. If you overfund or dump in extra PUAs without watching the limits, you could accidentally trip the MEC line.

A higher base premium makes the policy more conservative. It locks in stronger guarantees and requires less monitoring. But let’s be honest—there’s another reason. Agents get paid more commission on the base premium than on PUAs. So a 37/63 design not only feels safer to them, it also pays them more.

The MEC Question

MEC stands for Modified Endowment Contract. If a policy becomes a MEC, you lose the tax advantages on policy loans and withdrawals. That’s why everyone is cautious about it. But here’s the truth: both 90/10 and 37/63 can be designed to avoid MEC status. The difference is that 90/10 leaves you with a smaller safety margin.

Which Design Is Better?

It depends on what you want.

If your goal is early cash value and liquidity, 90/10 is usually the better design—as long as you or your advisor stay disciplined about funding.

If your goal is long-term stability and you don’t care about having much cash value in the early years, a higher base ratio like 37/63 may make sense.

The Bottom Line

Don’t let anyone convince you that 90/10 can’t work. It can, and I’ve seen it. At the same time, don’t ignore the risks. You have to know your priorities and be clear about what you want the policy to do for you.

When it comes down to it, the right ratio isn’t about what pays the agent more or what sounds safer in theory. It’s about matching the design to your goals and making sure the numbers line up.

Ready to Get Clarity?

If you want help cutting through the noise and setting up a policy that actually fits your financial strategy, let’s talk. I offer discovery calls where we look at your goals, break down your options, and put together a plan that makes sense for you.

You don’t need another sales pitch. You need a coach in your corner. Book your discovery call today and let’s make sure your money is working for you, not against you.